New Tax Bill (Page 4)

-

No new posts

No new posts

| Moderators: k9car363, alicefoeller | Reply |

|

2017-12-18 6:43 PM 2017-12-18 6:43 PM in reply to: Oysterboy in reply to: Oysterboy |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by Oysterboy Originally posted by mdg2003 California has a pretty good system of direct grants for science. They also put a lot of money into subsidizing a premier state educational system that has driven innovation there. I was raised in Massachusetts and although there the premier educational system is primarily private, I can assure you a state does not get that type of educational/R&D infrastructure without putting some skin in the game. Make no mistake about it, the fact that these states are benefitting from the innovation economy is not by accident. The key is to get other states to tap into this. Now the roads I cannot comment on, ever been to New Orleans? Fuggedaboudit. Originally posted by Oysterboy Oh hang on there a sec; you feel wages and property values are high in California because they invest their tax dollars in infrastructure? Maybe we don’t agree on what defines infrastructure because every time I visit California, I’m thankful I’m driving a rented front end and not my own. What infrastructure do they pump money into? I really can’t speak for east coast since I don’t frequent it enough to head an opinion based on what I’ve seen. Originally posted by tuwood I see your point. One counter argument is that those states, CA, MA, NY in particular have invested state money into the building of their infrastructure that has benefits for that state, this is why wages and property values are high in these states. However, that increased infrastructure has benefits that extend well beyond the borders of their states. Using your logic, the question is why should someone in Nebraska benefit from technological advances developed using California tax money, or benefit from pharmaceutics developed using state money in Massachusetts? I think I'm getting hosed. I live in Nebraska. lol I guess I'm not really sure what that has to do with SALT exemptions and estate taxes. If a person in say Florida is getting more "benefit" from the Federal government then I don't see why a person in California should get an extra deduction because they have high state income taxes, or a person in Nebraska should have a significant portion of their net worth confiscated versus passing it on to their children. I know CA is in tough financial trouble as are many other high tax liberal states and it seems to be that the major line items on the expense side are pensions and entitlements. I know there's a lot of other investment and expenses, but it's almost always the entitlements and pensions that bankrupt state and local budgets. |

|

2017-12-18 7:08 PM 2017-12-18 7:08 PM in reply to: tuwood in reply to: tuwood |

Champion  7547 7547     Albuquerque, New Mexico Albuquerque, New Mexico |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by tuwood Apparently Feinstein agrees that the tax bill doesn't help the wealthy

And so the people who bought into these inflated prices are going to take it in the shorts when it now takes $350K in income rather than $300K in income to buy that property before it slides into the sea? What's the average household income in those places? I think far less than $300K...Somewhere the math breaks down and I don't think it has much to do with deduction of property taxes or mortgage interest. |

2017-12-18 7:17 PM 2017-12-18 7:17 PM in reply to: McFuzz in reply to: McFuzz |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by McFuzz Originally posted by tuwood Apparently Feinstein agrees that the tax bill doesn't help the wealthy

And so the people who bought into these inflated prices are going to take it in the shorts when it now takes $350K in income rather than $300K in income to buy that property before it slides into the sea? What's the average household income in those places? I think far less than $300K...Somewhere the math breaks down and I don't think it has much to do with deduction of property taxes or mortgage interest. I think it's actually quite a bit less drastic of an issue because it's only prospective so all existing mortgages are exempt from the new rule. Then for the new ones it's only the amount that's over $750k that's not deductible. So if you buy an $850k house the interest on $750k of it is deductible and only the $100k isn't. |

2017-12-18 7:46 PM 2017-12-18 7:46 PM in reply to: #5232019 in reply to: #5232019 |

Expert  2373 2373       Floriduh Floriduh |  Subject: RE: New Tax Bill Subject: RE: New Tax Bill |

2017-12-18 8:43 PM 2017-12-18 8:43 PM in reply to: Oysterboy in reply to: Oysterboy |

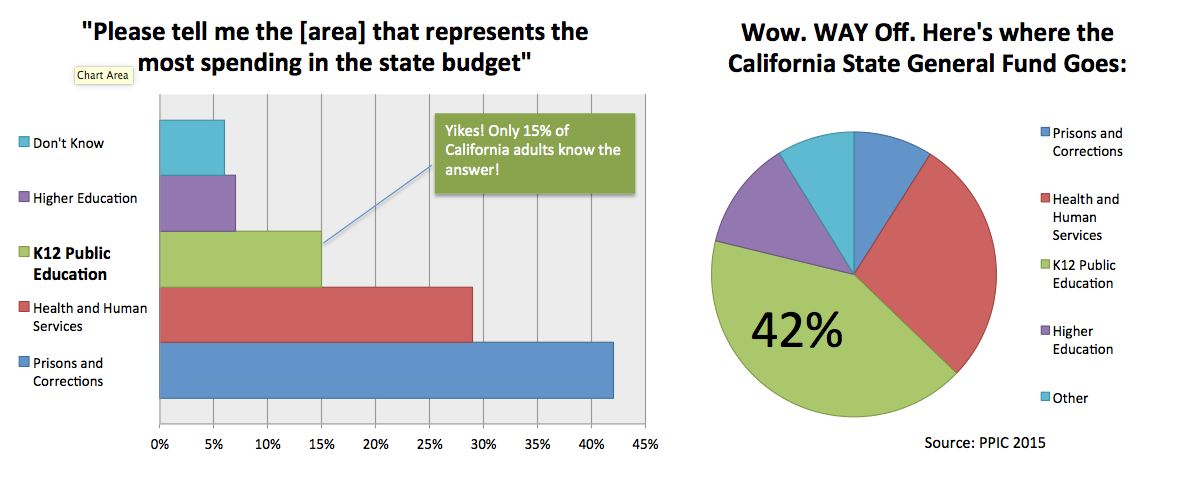

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by Oysterboy Fake news: https://www.usnews.com/news/business/articles/2017-01-11/california-... double fake news. I did read your article and it talks about revenues being up because of tax raises, but also spending has gone up. They're pretty vague on what they're spending on but a lot of it mentioned in that article would be classified as entitlements. It's also interesting that pensions don't seem to have a line item at all. Just out of curiosity I was trying to find where they spent most of the money and this was about the only thing I could find from 2015. Looks like K-12 is the biggest culprit.

|

2017-12-18 10:29 PM 2017-12-18 10:29 PM in reply to: 0 in reply to: 0 |

Pro  6838 6838        Tejas Tejas |  Subject: RE: New Tax Bill Subject: RE: New Tax BillSales taxes are depressed by healthcare costs. Thought they fixed that in Obama’s first term? Of course the Rs haven’t figured it out either. One surprise I did take away from the article was Jerry Brown looking for spending cuts to offset budget deficits. For a man with the reputation for spending like a drunken sailor that sounds awfully responsible. I wonder if he’s not the liberal nutjob he’s reported to be or if maybe the deficit issue is much larger than they are letting on. Is Jerry’s house of cards gonna crash? Edited by mdg2003 2017-12-18 10:30 PM |

|

2017-12-19 8:52 AM 2017-12-19 8:52 AM in reply to: mdg2003 in reply to: mdg2003 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by mdg2003 Sales taxes are depressed by healthcare costs. Thought they fixed that in Obama’s first term? Of course the Rs haven’t figured it out either. One surprise I did take away from the article was Jerry Brown looking for spending cuts to offset budget deficits. For a man with the reputation for spending like a drunken sailor that sounds awfully responsible. I wonder if he’s not the liberal nutjob he’s reported to be or if maybe the deficit issue is much larger than they are letting on. Is Jerry’s house of cards gonna crash? Most state laws have a balanced budget amendment so it's illegal to run a deficit. They do accounting tricks like mentioned in the article I posted above to hide unfunded liabilities on the balance sheet (typically pensions), but for the normal day to day spending it has to be in balance. |

2017-12-19 10:27 AM 2017-12-19 10:27 AM in reply to: tuwood in reply to: tuwood |

Expert  2373 2373       Floriduh Floriduh |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by tuwood Originally posted by mdg2003 Sales taxes are depressed by healthcare costs. Thought they fixed that in Obama’s first term? Of course the Rs haven’t figured it out either. One surprise I did take away from the article was Jerry Brown looking for spending cuts to offset budget deficits. For a man with the reputation for spending like a drunken sailor that sounds awfully responsible. I wonder if he’s not the liberal nutjob he’s reported to be or if maybe the deficit issue is much larger than they are letting on. Is Jerry’s house of cards gonna crash? Most state laws have a balanced budget amendment so it's illegal to run a deficit. They do accounting tricks like mentioned in the article I posted above to hide unfunded liabilities on the balance sheet (typically pensions), but for the normal day to day spending it has to be in balance. Tony's right, most states cannot legally deficit spend so they need to balance the budget. They do keep some liabilities off the books (primarily pension exposures) but it also means that they may not invest in critical infrastructure. I found this graphic, indicates it is really a mixed bag as to how well managed red/blue states are. Interesting Florida is #1, goes with our state motto: "Let the tourists pay for it". Attachments ---------------- fiscalrankings_2017_map (1).pdf (88KB - 11 downloads) |

2017-12-19 10:34 AM 2017-12-19 10:34 AM in reply to: Oysterboy in reply to: Oysterboy |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by Oysterboy Originally posted by tuwood Tony's right, most states cannot legally deficit spend so they need to balance the budget. They do keep some liabilities off the books (primarily pension exposures) but it also means that they may not invest in critical infrastructure. I found this graphic, indicates it is really a mixed bag as to how well managed red/blue states are. Interesting Florida is #1, goes with our state motto: "Let the tourists pay for it". Originally posted by mdg2003 Sales taxes are depressed by healthcare costs. Thought they fixed that in Obama’s first term? Of course the Rs haven’t figured it out either. One surprise I did take away from the article was Jerry Brown looking for spending cuts to offset budget deficits. For a man with the reputation for spending like a drunken sailor that sounds awfully responsible. I wonder if he’s not the liberal nutjob he’s reported to be or if maybe the deficit issue is much larger than they are letting on. Is Jerry’s house of cards gonna crash? Most state laws have a balanced budget amendment so it's illegal to run a deficit. They do accounting tricks like mentioned in the article I posted above to hide unfunded liabilities on the balance sheet (typically pensions), but for the normal day to day spending it has to be in balance. Can you say that again please? ;-) We just missed the top 5 in Nebraska. |

2017-12-19 11:02 AM 2017-12-19 11:02 AM in reply to: Oysterboy in reply to: Oysterboy |

Pro  6838 6838        Tejas Tejas |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by Oysterboy Originally posted by tuwood Originally posted by mdg2003 Sales taxes are depressed by healthcare costs. Thought they fixed that in Obama’s first term? Of course the Rs haven’t figured it out either. One surprise I did take away from the article was Jerry Brown looking for spending cuts to offset budget deficits. For a man with the reputation for spending like a drunken sailor that sounds awfully responsible. I wonder if he’s not the liberal nutjob he’s reported to be or if maybe the deficit issue is much larger than they are letting on. Is Jerry’s house of cards gonna crash? Most state laws have a balanced budget amendment so it's illegal to run a deficit. They do accounting tricks like mentioned in the article I posted above to hide unfunded liabilities on the balance sheet (typically pensions), but for the normal day to day spending it has to be in balance. Tony's right, most states cannot legally deficit spend so they need to balance the budget. They do keep some liabilities off the books (primarily pension exposures) but it also means that they may not invest in critical infrastructure. I found this graphic, indicates it is really a mixed bag as to how well managed red/blue states are. Interesting Florida is #1, goes with our state motto: "Let the tourists pay for it". Will be there tonight spending my tourist dollars before getting on a boat! |

2017-12-19 11:04 AM 2017-12-19 11:04 AM in reply to: mdg2003 in reply to: mdg2003 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by mdg2003 Originally posted by Oysterboy Will be there tonight spending my tourist dollars before getting on a boat! Originally posted by tuwood Tony's right, most states cannot legally deficit spend so they need to balance the budget. They do keep some liabilities off the books (primarily pension exposures) but it also means that they may not invest in critical infrastructure. I found this graphic, indicates it is really a mixed bag as to how well managed red/blue states are. Interesting Florida is #1, goes with our state motto: "Let the tourists pay for it". Originally posted by mdg2003 Sales taxes are depressed by healthcare costs. Thought they fixed that in Obama’s first term? Of course the Rs haven’t figured it out either. One surprise I did take away from the article was Jerry Brown looking for spending cuts to offset budget deficits. For a man with the reputation for spending like a drunken sailor that sounds awfully responsible. I wonder if he’s not the liberal nutjob he’s reported to be or if maybe the deficit issue is much larger than they are letting on. Is Jerry’s house of cards gonna crash? Most state laws have a balanced budget amendment so it's illegal to run a deficit. They do accounting tricks like mentioned in the article I posted above to hide unfunded liabilities on the balance sheet (typically pensions), but for the normal day to day spending it has to be in balance. We're heading to Gulf Shores, AL on the 28th and then up to Atlanta for the Peach Bowl. |

|

2017-12-19 11:22 AM 2017-12-19 11:22 AM in reply to: tuwood in reply to: tuwood |

Champion  10154 10154      Alabama Alabama |  Subject: RE: New Tax Bill Subject: RE: New Tax BillI saw in the news a new CNN poll that claims like 55% of American oppose the tax plan. I had to chuckle. 99% of Americans have not idea what is in the tax bill. All they know is that the talking heads in the MSM are saying about and the MSM has been trying to kill it from the beginning. Contrary to what the talking heads on TV think, the vast majority of Americans are only vaguely aware that "some tax issue" is working thru Congress. Most people have job and work all day and come home and watch the evening news then switch over to Dancing with the Stars and veg out. There are political hacks like me who surf between Fox, CNN and MSNBC but most people are not that stupid. Anyway, to think that most Americans oppose the tax plan when most American will be paying less tax is ludicrous. BTW, that is the reason we are not a democracy! Most people have neither the time nor inclination to read and understand complex legislation. We are a represented republic and our congressmen are elected to vote for us. In an off-topic..... When I was 11 years old my older sister's BF came to the house in a Corvette. I fell in love!! I asked him if I could buy his car for $1,000 and he lauched and said "Which stripe [it had 2 racing stripes] do you want?" So all my life I've wanted to own a Vette. I finally found a great deal and pulled the trigger! (IMG_0419.JPG) Attachments ---------------- IMG_0419.JPG (175KB - 9 downloads) |

2017-12-19 11:31 AM 2017-12-19 11:31 AM in reply to: Rogillio in reply to: Rogillio |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax Billhaha, congrats on the vette. When i was in High School I saved everything I made and bought a 1980 Z-28 Camaro and did what I could to fix it up. I've seriously thought about buying another one and really restoring it. It would be a fun project connecting me to my youth. |

2017-12-19 12:20 PM 2017-12-19 12:20 PM in reply to: Rogillio in reply to: Rogillio |

Pro  6838 6838        Tejas Tejas |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by Rogillio I saw in the news a new CNN poll that claims like 55% of American oppose the tax plan. I had to chuckle. 99% of Americans have not idea what is in the tax bill. All they know is that the talking heads in the MSM are saying about and the MSM has been trying to kill it from the beginning. Contrary to what the talking heads on TV think, the vast majority of Americans are only vaguely aware that "some tax issue" is working thru Congress. Most people have job and work all day and come home and watch the evening news then switch over to Dancing with the Stars and veg out. There are political hacks like me who surf between Fox, CNN and MSNBC but most people are not that stupid. Anyway, to think that most Americans oppose the tax plan when most American will be paying less tax is ludicrous. BTW, that is the reason we are not a democracy! Most people have neither the time nor inclination to read and understand complex legislation. We are a represented republic and our congressmen are elected to vote for us. In an off-topic..... When I was 11 years old my older sister's BF came to the house in a Corvette. I fell in love!! I asked him if I could buy his car for $1,000 and he lauched and said "Which stripe [it had 2 racing stripes] do you want?" So all my life I've wanted to own a Vette. I finally found a great deal and pulled the trigger! Nice ride! CNN poll question - Do you oppose the tax plan that Satan... uhh Trump and his rich buddies are cramming through Congress against the will of the people right now; the tax plan that will give rich people obscene tax breaks and destroy the middle class and drive poor people out into the streets in droves where they'll be forced to eat kittens? Yes or no. Yeah, I saw that this AM too and had to take it with a grain of salt. Imagine FOX has one telling us how many folks favor it. |

2017-12-19 12:56 PM 2017-12-19 12:56 PM in reply to: tuwood in reply to: tuwood |

Expert  2373 2373       Floriduh Floriduh |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by tuwood Originally posted by Oysterboy Originally posted by tuwood Tony's right, most states cannot legally deficit spend so they need to balance the budget. They do keep some liabilities off the books (primarily pension exposures) but it also means that they may not invest in critical infrastructure. I found this graphic, indicates it is really a mixed bag as to how well managed red/blue states are. Interesting Florida is #1, goes with our state motto: "Let the tourists pay for it". Originally posted by mdg2003 Sales taxes are depressed by healthcare costs. Thought they fixed that in Obama’s first term? Of course the Rs haven’t figured it out either. One surprise I did take away from the article was Jerry Brown looking for spending cuts to offset budget deficits. For a man with the reputation for spending like a drunken sailor that sounds awfully responsible. I wonder if he’s not the liberal nutjob he’s reported to be or if maybe the deficit issue is much larger than they are letting on. Is Jerry’s house of cards gonna crash? Most state laws have a balanced budget amendment so it's illegal to run a deficit. They do accounting tricks like mentioned in the article I posted above to hide unfunded liabilities on the balance sheet (typically pensions), but for the normal day to day spending it has to be in balance. Can you say that again please? ;-) We just missed the top 5 in Nebraska. Don't get too excited there Bubba, blind hogs occasionally find acorns |

2017-12-19 1:04 PM 2017-12-19 1:04 PM in reply to: mdg2003 in reply to: mdg2003 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by mdg2003 Originally posted by Rogillio I saw in the news a new CNN poll that claims like 55% of American oppose the tax plan. I had to chuckle. 99% of Americans have not idea what is in the tax bill. All they know is that the talking heads in the MSM are saying about and the MSM has been trying to kill it from the beginning. Contrary to what the talking heads on TV think, the vast majority of Americans are only vaguely aware that "some tax issue" is working thru Congress. Most people have job and work all day and come home and watch the evening news then switch over to Dancing with the Stars and veg out. There are political hacks like me who surf between Fox, CNN and MSNBC but most people are not that stupid. Anyway, to think that most Americans oppose the tax plan when most American will be paying less tax is ludicrous. BTW, that is the reason we are not a democracy! Most people have neither the time nor inclination to read and understand complex legislation. We are a represented republic and our congressmen are elected to vote for us. In an off-topic..... When I was 11 years old my older sister's BF came to the house in a Corvette. I fell in love!! I asked him if I could buy his car for $1,000 and he lauched and said "Which stripe [it had 2 racing stripes] do you want?" So all my life I've wanted to own a Vette. I finally found a great deal and pulled the trigger! Nice ride! CNN poll question - Do you oppose the tax plan that Satan... uhh Trump and his rich buddies are cramming through Congress against the will of the people right now; the tax plan that will give rich people obscene tax breaks and destroy the middle class and drive poor people out into the streets in droves where they'll be forced to eat kittens? Yes or no. Yeah, I saw that this AM too and had to take it with a grain of salt. Imagine FOX has one telling us how many folks favor it. The Harvard CAPS poll is the one that everybody is parading around as proof Americans hate this law, but the funny part about it is inside the same poll they ask if people support lower taxes and tax reform the support is overwhelming. It's another case of fake news and media pumping an agenda to spoon feed opinions to uninformed people. The wording you used in your question isn't far from how it's being framed for them so of course they're going to oppose it. |

|

2017-12-19 1:15 PM 2017-12-19 1:15 PM in reply to: Oysterboy in reply to: Oysterboy |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by Oysterboy Originally posted by tuwood Don't get too excited there Bubba, blind hogs occasionally find acorns Originally posted by Oysterboy Originally posted by tuwood Tony's right, most states cannot legally deficit spend so they need to balance the budget. They do keep some liabilities off the books (primarily pension exposures) but it also means that they may not invest in critical infrastructure. I found this graphic, indicates it is really a mixed bag as to how well managed red/blue states are. Interesting Florida is #1, goes with our state motto: "Let the tourists pay for it". Originally posted by mdg2003 Sales taxes are depressed by healthcare costs. Thought they fixed that in Obama’s first term? Of course the Rs haven’t figured it out either. One surprise I did take away from the article was Jerry Brown looking for spending cuts to offset budget deficits. For a man with the reputation for spending like a drunken sailor that sounds awfully responsible. I wonder if he’s not the liberal nutjob he’s reported to be or if maybe the deficit issue is much larger than they are letting on. Is Jerry’s house of cards gonna crash? Most state laws have a balanced budget amendment so it's illegal to run a deficit. They do accounting tricks like mentioned in the article I posted above to hide unfunded liabilities on the balance sheet (typically pensions), but for the normal day to day spending it has to be in balance. Can you say that again please? ;-) We just missed the top 5 in Nebraska. But I find so few of them, I have to enjoy the ones I do find. :-D |

2017-12-19 1:24 PM 2017-12-19 1:24 PM in reply to: tuwood in reply to: tuwood |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillHere's another poll about how the media has treated Trump. https://shorensteincenter.org/news-coverage-donald-trumps-first-100-days/ *Trump has received unsparing coverage for most weeks of his presidency, without a single major topic where Trump’s coverage, on balance, was more positive than negative, setting a new standard for unfavorable press coverage of a president. *Fox was the only news outlet in the study that came close to giving Trump positive coverage overall, however, there was variation in the tone of Fox’s coverage depending on the topic. |

2017-12-19 1:37 PM 2017-12-19 1:37 PM in reply to: tuwood in reply to: tuwood |

Champion  10154 10154      Alabama Alabama |  Subject: RE: New Tax Bill Subject: RE: New Tax BillAt some point, even the most ignorant start to realize when they're being duped repeatedly. You'd think...... |

2017-12-19 2:08 PM 2017-12-19 2:08 PM in reply to: Rogillio in reply to: Rogillio |

Champion  10154 10154      Alabama Alabama |  Subject: RE: New Tax Bill Subject: RE: New Tax BillSo it passed in the house. The sad thing is, although 12 reps voted against it, not a single democrat voted for it. I think next fall every republican on the ballot needs to run on the fact that the democrat voted against lower taxes and tax reform. Dems on the other hand can run against Roy Moore. ;-) |

2017-12-19 4:01 PM 2017-12-19 4:01 PM in reply to: Rogillio in reply to: Rogillio |

Extreme Veteran  3025 3025    Maryland Maryland |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by Rogillio So it passed in the house. The sad thing is, although 12 reps voted against it, not a single democrat voted for it. I think next fall every republican on the ballot needs to run on the fact that the democrat voted against lower taxes and tax reform. Dems on the other hand can run against Roy Moore. ;-)

why would they vote for it? the bill was written behind closed doors, they haven't gotten to read it, and the republicans literally said, we don't want your help, input, or suggestions. |

|

2017-12-19 4:37 PM 2017-12-19 4:37 PM in reply to: dmiller5 in reply to: dmiller5 |

Expert  2373 2373       Floriduh Floriduh |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by dmiller5 Originally posted by Rogillio So it passed in the house. The sad thing is, although 12 reps voted against it, not a single democrat voted for it. I think next fall every republican on the ballot needs to run on the fact that the democrat voted against lower taxes and tax reform. Dems on the other hand can run against Roy Moore. ;-)

why would they vote for it? the bill was written behind closed doors, they haven't gotten to read it, and the republicans literally said, we don't want your help, input, or suggestions. Yep, same as Obama care and that wasn't good for dems. Dems won't need to run against Moore when they have Trump. |

2017-12-19 5:48 PM 2017-12-19 5:48 PM in reply to: dmiller5 in reply to: dmiller5 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillOriginally posted by dmiller5 Originally posted by Rogillio So it passed in the house. The sad thing is, although 12 reps voted against it, not a single democrat voted for it. I think next fall every republican on the ballot needs to run on the fact that the democrat voted against lower taxes and tax reform. Dems on the other hand can run against Roy Moore. ;-)

why would they vote for it? the bill was written behind closed doors, they haven't gotten to read it, and the republicans literally said, we don't want your help, input, or suggestions. They would vote for it because when it turns out to be the law that results in great prosperity to their constituents they don't want to be on the wrong side of it. The law has been out for many weeks in both the house and senate forms and the final form was out for a couple weeks I believe. As for the republicans saying they don't want your help I would respectfully disagree with you. Trump and leadership asked them several times to come to the table and they refused. Remember the famous empty chairs next to Trump debacle?

|

2017-12-19 7:00 PM 2017-12-19 7:00 PM in reply to: tuwood in reply to: tuwood |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: New Tax Bill Subject: RE: New Tax BillThis is what the Democrats voted against. I know they've been trying to fool everyone and say that only the rich benefit from the cuts, but reality is going to hit them hard. The only logical argument they could make would be that they don't feel the revenue will overcome the cuts and they may be right or they may be wrong.

|

2017-12-19 7:47 PM 2017-12-19 7:47 PM in reply to: tuwood in reply to: tuwood |

Expert  2373 2373       Floriduh Floriduh |  Subject: RE: New Tax Bill Subject: RE: New Tax BillI don't think this will play as such a huge victory for either the GOP or the Dems. Just too complicated and outcomes too heterogenous. One thing that really stumps me is why they dropped the top marginal rate so much, or at all for that fact. It just smacks of a donor-centric move, why would they open themselves up for such an obvious negative talking point, beyond me. I'm not stimulating anything with any money I get, it will go directly into my 403b. |

|

| tax reform - where do you stand? Pages: 1 2 | ||

| |||

| |||

| The press and the new administration Pages: 1 2 3 4 |

login

login

View profile

View profile Add to friends

Add to friends Go to training log

Go to training log Go to race log

Go to race log Send a message

Send a message View album

View album

CONNECT WITH FACEBOOK

CONNECT WITH FACEBOOK