Gen Y Entitlement (Page 2)

-

No new posts

No new posts

| Moderators: k9car363, alicefoeller | Reply |

|

2013-09-18 6:03 PM 2013-09-18 6:03 PM in reply to: Aarondb4 in reply to: Aarondb4 |

Pro  15655 15655       |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. One of my daughters is in pharmaceutical sales....a deal with the devil if you ask me, but it's her life..... she was wooed from a previous company to her present position, partly, by the promise of paying down her student loans by half. I'd pay off a home before I'd even considered paying more to a student loan...at least you can look forward to some equity from that.....paying off a student loan early is throwing money at something that is already paying you big dividends in the extra salary you make BECAUSE you took the loan and got the degree. In my wife's case, she probably makes 4 times what she could have made without a degree......so she pays 2400.00 per year for an extra 50-75K in salary....it's not even worth thinking about. |

|

2013-09-19 1:54 AM 2013-09-19 1:54 AM in reply to: Aarondb4 in reply to: Aarondb4 |

Science Nerd  28760 28760             Redwood City, California Redwood City, California |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. Getting rid of student loan debt early makes no sense to me. I have my loans consolidated at 3% interest. I could pay extra to my student loans every month OR I could put more in my retirement account where it will make more than 3%. Why wouldn't I save more? |

2013-09-19 8:19 AM 2013-09-19 8:19 AM in reply to: Artemis in reply to: Artemis |

Extreme Veteran  3025 3025    Maryland Maryland |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by Artemis Originally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. Getting rid of student loan debt early makes no sense to me. I have my loans consolidated at 3% interest. I could pay extra to my student loans every month OR I could put more in my retirement account where it will make more than 3%. Why wouldn't I save more? beacause you are lucky to have the cheapest loan interest ever. Nowadays its more like 6% |

2013-09-19 8:34 AM 2013-09-19 8:34 AM in reply to: dmiller5 in reply to: dmiller5 |

Elite  4564 4564      Boise Boise |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by dmiller5 Originally posted by Artemis Originally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. Getting rid of student loan debt early makes no sense to me. I have my loans consolidated at 3% interest. I could pay extra to my student loans every month OR I could put more in my retirement account where it will make more than 3%. Why wouldn't I save more? beacause you are lucky to have the cheapest loan interest ever. Nowadays its more like 6% Yep, the weighted average on mine is 6.75% |

2013-09-19 8:49 AM 2013-09-19 8:49 AM in reply to: JoshR in reply to: JoshR |

Pro  15655 15655       |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by JoshR Originally posted by dmiller5 Yep, the weighted average on mine is 6.75% Originally posted by Artemis Originally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. Getting rid of student loan debt early makes no sense to me. I have my loans consolidated at 3% interest. I could pay extra to my student loans every month OR I could put more in my retirement account where it will make more than 3%. Why wouldn't I save more? beacause you are lucky to have the cheapest loan interest ever. Nowadays its more like 6% That makes a bit of a difference, but you still have to look at the big picture. Have you been tracking the stock market in the last year? I have mutual fund accounts that are 100% stock loaded that have returned nearly 20% in the last calendar year. I never missed an opportunity when I was younger to put extra money into my retirement account.......and never worried about paying down debt. Most of the debt is gone......and my retirement account has out performed the accounts of my peers by huge margins. Find a few historically good stock loaded mutual funds, put extra money in them whenever you can, don't try to out think the markets by moving money all over the place, be patient, and you'll be surprised where you can be in 20 or 30 years......so yeah, back to the origional point of the post.....while I don't necessarily agree that Gen Y'ers feel a sense of entitlement, ya'll are some of the most impatient and short sighted folks that have come along in a while. |

2013-09-19 9:04 AM 2013-09-19 9:04 AM in reply to: Left Brain in reply to: Left Brain |

Elite  4564 4564      Boise Boise |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by Left Brain Originally posted by JoshR Originally posted by dmiller5 Yep, the weighted average on mine is 6.75% Originally posted by Artemis Originally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. Getting rid of student loan debt early makes no sense to me. I have my loans consolidated at 3% interest. I could pay extra to my student loans every month OR I could put more in my retirement account where it will make more than 3%. Why wouldn't I save more? beacause you are lucky to have the cheapest loan interest ever. Nowadays its more like 6% That makes a bit of a difference, but you still have to look at the big picture. Have you been tracking the stock market in the last year? I have mutual fund accounts that are 100% stock loaded that have returned nearly 20% in the last calendar year. I never missed an opportunity when I was younger to put extra money into my retirement account.......and never worried about paying down debt. Most of the debt is gone......and my retirement account has out performed the accounts of my peers by huge margins. Find a few historically good stock loaded mutual funds, put extra money in them whenever you can, don't try to out think the markets by moving money all over the place, be patient, and you'll be surprised where you can be in 20 or 30 years......so yeah, back to the origional point of the post.....while I don't necessarily agree that Gen Y'ers feel a sense of entitlement, ya'll are some of the most impatient and short sighted folks that have come along in a while. That's a short term look at it though. What is the return on your portfolio over the last decade? Is it beating the 6.75%? Chances are if you're a gen Y/millenial (1984 for me so whichever that would qualify me as) you're not seeing the long term stock gains. The last 13 years or so have not been kind to most indexes. If you're like me and you think the Fed is currently inflating the markets as well, then this years gains are not normal. I don't want to try and gamble that I timed it right so I am not trying to put extra into the market anywhere. |

|

2013-09-19 9:42 AM 2013-09-19 9:42 AM in reply to: JoshR in reply to: JoshR |

Pro  15655 15655       |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by JoshR Originally posted by Left Brain That's a short term look at it though. What is the return on your portfolio over the last decade? Is it beating the 6.75%? Chances are if you're a gen Y/millenial (1984 for me so whichever that would qualify me as) you're not seeing the long term stock gains. The last 13 years or so have not been kind to most indexes. If you're like me and you think the Fed is currently inflating the markets as well, then this years gains are not normal. I don't want to try and gamble that I timed it right so I am not trying to put extra into the market anywhere. Originally posted by JoshR Originally posted by dmiller5 Yep, the weighted average on mine is 6.75% Originally posted by Artemis Originally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. Getting rid of student loan debt early makes no sense to me. I have my loans consolidated at 3% interest. I could pay extra to my student loans every month OR I could put more in my retirement account where it will make more than 3%. Why wouldn't I save more? beacause you are lucky to have the cheapest loan interest ever. Nowadays its more like 6% That makes a bit of a difference, but you still have to look at the big picture. Have you been tracking the stock market in the last year? I have mutual fund accounts that are 100% stock loaded that have returned nearly 20% in the last calendar year. I never missed an opportunity when I was younger to put extra money into my retirement account.......and never worried about paying down debt. Most of the debt is gone......and my retirement account has out performed the accounts of my peers by huge margins. Find a few historically good stock loaded mutual funds, put extra money in them whenever you can, don't try to out think the markets by moving money all over the place, be patient, and you'll be surprised where you can be in 20 or 30 years......so yeah, back to the origional point of the post.....while I don't necessarily agree that Gen Y'ers feel a sense of entitlement, ya'll are some of the most impatient and short sighted folks that have come along in a while. Josh....no offense, but you tend to look at the negative side of everything. I didn't move a single penny when the market crashed and everyone I knew bailed out. All it meant to me was that I was buying CHEAP by staying in. The market isn't run by guys with negative attitudes.....it's run by people who want to make money. You can't sit in your seat and make predicitons about what the Fed is doing, etc......you just don't have access to that information. What you have to do is look at long term trends. Here, without getting into exact numbers, I have an account I opened in 1986. I have put 225,000 into it...... it's worth 610,000 today. I'm happy with that return, and I'm happy I didn't try to use themoney I put into that account to pay off my house, or student loans, or any other debt.....because the debt got paid off anyway, and I have that account waiting on me that will bridge me over to my pension account. Since you like to make predicitons.....I'll make one too..... go ahead and sit on the sideline and wring your hands....you're about to miss out on one of the biggest economic recoveries in history. It's what giant economies do....they go up and down. The size of the recoveries tend to mirror the size of the downturns. There is alot to be happy about with the housing numbers, oil production, natural gas production, and general growth of the economy. You can say the Fed is propping up the markets all you want......the Fed doesn't make the markets run.....the guys making the money do. |

2013-09-19 9:56 AM 2013-09-19 9:56 AM in reply to: Left Brain in reply to: Left Brain |

Member  465 465      |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementI'll cut the generation Y'ers a little slack just on the basis that they had to spend their 20's fighting their parent's war. |

2013-09-19 10:00 AM 2013-09-19 10:00 AM in reply to: Left Brain in reply to: Left Brain |

Elite  4564 4564      Boise Boise |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by Left Brain Originally posted by JoshR Originally posted by Left Brain That's a short term look at it though. What is the return on your portfolio over the last decade? Is it beating the 6.75%? Chances are if you're a gen Y/millenial (1984 for me so whichever that would qualify me as) you're not seeing the long term stock gains. The last 13 years or so have not been kind to most indexes. If you're like me and you think the Fed is currently inflating the markets as well, then this years gains are not normal. I don't want to try and gamble that I timed it right so I am not trying to put extra into the market anywhere. Originally posted by JoshR Originally posted by dmiller5 Yep, the weighted average on mine is 6.75% Originally posted by Artemis Originally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. Getting rid of student loan debt early makes no sense to me. I have my loans consolidated at 3% interest. I could pay extra to my student loans every month OR I could put more in my retirement account where it will make more than 3%. Why wouldn't I save more? beacause you are lucky to have the cheapest loan interest ever. Nowadays its more like 6% That makes a bit of a difference, but you still have to look at the big picture. Have you been tracking the stock market in the last year? I have mutual fund accounts that are 100% stock loaded that have returned nearly 20% in the last calendar year. I never missed an opportunity when I was younger to put extra money into my retirement account.......and never worried about paying down debt. Most of the debt is gone......and my retirement account has out performed the accounts of my peers by huge margins. Find a few historically good stock loaded mutual funds, put extra money in them whenever you can, don't try to out think the markets by moving money all over the place, be patient, and you'll be surprised where you can be in 20 or 30 years......so yeah, back to the origional point of the post.....while I don't necessarily agree that Gen Y'ers feel a sense of entitlement, ya'll are some of the most impatient and short sighted folks that have come along in a while. Josh....no offense, but you tend to look at the negative side of everything. I didn't move a single penny when the market crashed and everyone I knew bailed out. All it meant to me was that I was buying CHEAP by staying in. The market isn't run by guys with negative attitudes.....it's run by people who want to make money. You can't sit in your seat and make predicitons about what the Fed is doing, etc......you just don't have access to that information. What you have to do is look at long term trends. Here, without getting into exact numbers, I have an account I opened in 1986. I have put 225,000 into it...... it's worth 610,000 today. I'm happy with that return, and I'm happy I didn't try to use themoney I put into that account to pay off my house, or student loans, or any other debt.....because the debt got paid off anyway, and I have that account waiting on me that will bridge me over to my pension account. Since you like to make predicitons.....I'll make one too..... go ahead and sit on the sideline and wring your hands....you're about to miss out on one of the biggest economic recoveries in history. It's what giant economies do....they go up and down. The size of the recoveries tend to mirror the size of the downturns. There is alot to be happy about with the housing numbers, oil production, natural gas production, and general growth of the economy. You can say the Fed is propping up the markets all you want......the Fed doesn't make the markets run.....the guys making the money do. You are entitled to your own optimistic opinion. I know I am a bit of a pessimist when it comes to the broader picture, but I'm surprisingly optimistic about my own life. I have control over one of those is probably why. Bringing this back on topic a bit though, I think you will find the recovery is hampered by the large numbers of young people who are being overwhelmed with student loans and a poor job situation. A whole decade of earners are not going to be able to boost the economy like their predecessors and that is going to show up sooner or later. |

2013-09-19 10:08 AM 2013-09-19 10:08 AM in reply to: JoshR in reply to: JoshR |

Pro  15655 15655       |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by JoshR Originally posted by Left Brain You are entitled to your own optimistic opinion. I know I am a bit of a pessimist when it comes to the broader picture, but I'm surprisingly optimistic about my own life. I have control over one of those is probably why. Bringing this back on topic a bit though, I think you will find the recovery is hampered by the large numbers of young people who are being overwhelmed with student loans and a poor job situation. A whole decade of earners are not going to be able to boost the economy like their predecessors and that is going to show up sooner or later. Originally posted by JoshR Originally posted by Left Brain That's a short term look at it though. What is the return on your portfolio over the last decade? Is it beating the 6.75%? Chances are if you're a gen Y/millenial (1984 for me so whichever that would qualify me as) you're not seeing the long term stock gains. The last 13 years or so have not been kind to most indexes. If you're like me and you think the Fed is currently inflating the markets as well, then this years gains are not normal. I don't want to try and gamble that I timed it right so I am not trying to put extra into the market anywhere. Originally posted by JoshR Originally posted by dmiller5 Yep, the weighted average on mine is 6.75% Originally posted by Artemis Originally posted by Aarondb4 Originally posted by Left Brain Originally posted by Aarondb4 Originally posted by Left Brain My wife has a 6 figure income.....and still owes about 25,000 in student loans from a degree she earned 20 years ago. She pays the absolute minimum, and always will....I think she has it down to a couple hundred bucks per month due to some govt. refinance program she found. She looks at it as the price of a decent job and doesn't give it a thought. Both of my older daughters have fairly large student loans as well.....and both make fairly large incomes to go along with it.....they do the same.....figure out what the minimum payment would be to still be compliant.....and pay that. There is NO WAY in hell I would work to quickly pay off a student loan.....especially if you are not settled in your career. You could end up with a company or other entity that pays your loan off for you. Has your wife ever calculated the total interest she has paid over those 20 years? Bet it's ugly. Who cares? It's an absolute fraction of the money she has made from her salary. I'll say this for you Gen Y'ers....you sure like to make life complicated. Haha, doesn't matter to me what your wife does with her money. But I can see a lot of value in getting rid of debt quickly, can open up other opportunities or just put one in a better position in case something unexpected happens. Is the idea of a company paying off your student loan commonplace? I have never heard of such a thing. Getting rid of student loan debt early makes no sense to me. I have my loans consolidated at 3% interest. I could pay extra to my student loans every month OR I could put more in my retirement account where it will make more than 3%. Why wouldn't I save more? beacause you are lucky to have the cheapest loan interest ever. Nowadays its more like 6% That makes a bit of a difference, but you still have to look at the big picture. Have you been tracking the stock market in the last year? I have mutual fund accounts that are 100% stock loaded that have returned nearly 20% in the last calendar year. I never missed an opportunity when I was younger to put extra money into my retirement account.......and never worried about paying down debt. Most of the debt is gone......and my retirement account has out performed the accounts of my peers by huge margins. Find a few historically good stock loaded mutual funds, put extra money in them whenever you can, don't try to out think the markets by moving money all over the place, be patient, and you'll be surprised where you can be in 20 or 30 years......so yeah, back to the origional point of the post.....while I don't necessarily agree that Gen Y'ers feel a sense of entitlement, ya'll are some of the most impatient and short sighted folks that have come along in a while. Josh....no offense, but you tend to look at the negative side of everything. I didn't move a single penny when the market crashed and everyone I knew bailed out. All it meant to me was that I was buying CHEAP by staying in. The market isn't run by guys with negative attitudes.....it's run by people who want to make money. You can't sit in your seat and make predicitons about what the Fed is doing, etc......you just don't have access to that information. What you have to do is look at long term trends. Here, without getting into exact numbers, I have an account I opened in 1986. I have put 225,000 into it...... it's worth 610,000 today. I'm happy with that return, and I'm happy I didn't try to use themoney I put into that account to pay off my house, or student loans, or any other debt.....because the debt got paid off anyway, and I have that account waiting on me that will bridge me over to my pension account. Since you like to make predicitons.....I'll make one too..... go ahead and sit on the sideline and wring your hands....you're about to miss out on one of the biggest economic recoveries in history. It's what giant economies do....they go up and down. The size of the recoveries tend to mirror the size of the downturns. There is alot to be happy about with the housing numbers, oil production, natural gas production, and general growth of the economy. You can say the Fed is propping up the markets all you want......the Fed doesn't make the markets run.....the guys making the money do. The job situation will improve......student loan debt is NEVER going to be an idicator for economic growth or downturn. Sorry. |

2013-09-19 10:53 AM 2013-09-19 10:53 AM in reply to: Left Brain in reply to: Left Brain |

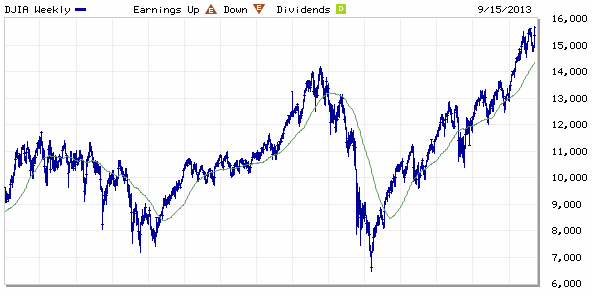

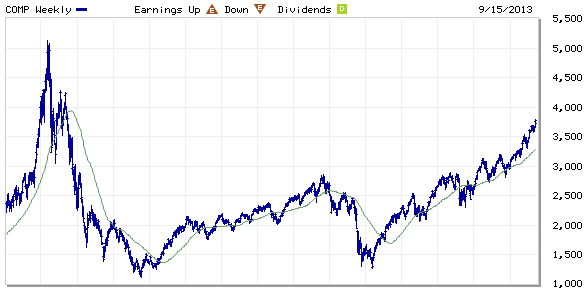

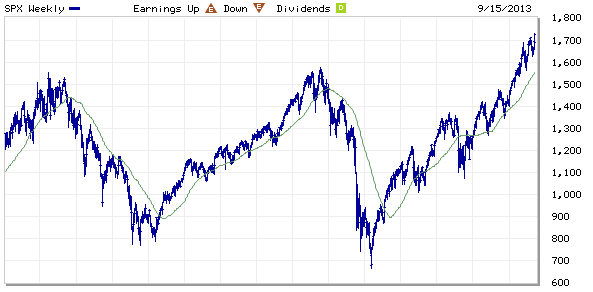

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by Left Brain Josh....no offense, but you tend to look at the negative side of everything. I didn't move a single penny when the market crashed and everyone I knew bailed out. All it meant to me was that I was buying CHEAP by staying in. The market isn't run by guys with negative attitudes.....it's run by people who want to make money. You can't sit in your seat and make predicitons about what the Fed is doing, etc......you just don't have access to that information. What you have to do is look at long term trends. Here, without getting into exact numbers, I have an account I opened in 1986. I have put 225,000 into it...... it's worth 610,000 today. I'm happy with that return, and I'm happy I didn't try to use themoney I put into that account to pay off my house, or student loans, or any other debt.....because the debt got paid off anyway, and I have that account waiting on me that will bridge me over to my pension account. Since you like to make predicitons.....I'll make one too..... go ahead and sit on the sideline and wring your hands....you're about to miss out on one of the biggest economic recoveries in history. It's what giant economies do....they go up and down. The size of the recoveries tend to mirror the size of the downturns. There is alot to be happy about with the housing numbers, oil production, natural gas production, and general growth of the economy. You can say the Fed is propping up the markets all you want......the Fed doesn't make the markets run.....the guys making the money do. The stock market has been doing great, but it's a Lance Armstrong stock market due to the Fed pumping. You can say it's fundamental business growing it, but you're wrong. You notice how it shot up yesterday? It shot up because the Fed said the economy is still crappy and they would continue pumping? Remember there were a lot of people who felt very good about their portfolios in 2000 and 2008 when the markets were at record highs and saying the recovery would keep going and going... It all went poof and took over five years to recover in each instance (NASD still hasn't recovered after 13 years). As you mentioned buy and hold will generally get you back to where you started, but if it takes 5 years to get back to a net 0 then that's not a good long term investment. It's certainly not good for managing your principle in retirement. So back to buy and hold versus timing, you can absolutely make great returns in the stock market if you time it right. However, if you don't time it right then you either lose a ton or make virtually no gains over a decade. The markets have essentially had absolutely no change with a lot of volatility for 5 years. all of the "great gains" have happened in the last year and a half. These charts are from 1999 through today. DJIA: NASD: SPX Now don't get me wrong. The stock market is a great place to make money, and I'm a very active trader. However, I recognize that the markets will go up and they will go down. I have learned to recognize this and use it to my advantage. It's not a matter of doomsday pessimism or anything, it's a matter of being smart with our money. Also, big congrats on your portfolio growth. Now don't go riding it back to $200k when the next recession hits. |

|

2013-09-19 11:08 AM 2013-09-19 11:08 AM in reply to: Left Brain in reply to: Left Brain |

Expert  3126 3126     Boise, ID Boise, ID |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y Entitlement

Okay, I'll wade back in... LB, your wife's N=1 sounds like a great situation, not everyone's situation is so great. Not everyone can make an extra $50k with a degree, many need the degree just to make the first $40-50k. Also, I don't know what your wife does but it sounds like she has some pretty good job security, not everyone has that. Also, your wife is in a dual income family, not everyone is. For example. My sister got a doctorate and is over $100k in debt between her degree and her husbands master's degree. She had to spend a lot of time in school so by the time she got out she had the baby making fever. So now they have two kids and she is the only one working. They bought a house but had to settle a bit because their debt to income ratio was too high based on the student loans. Her interest rate is close to 7% so her minimum payments are up there (not sure exact amount). She is a pediatric physical therapist, she has a dream of opening her own shop. Unfortunately due to her debt to income ratio she would have a very hard time getting a business loan and then would have an even harder time paying the debt, supporting the family and paying back on a business loan along with the house. She pays over $1k a month in student loans, imagine what she could do with that income freed up and her debt to income ratio much lower. Around here her job pays around $50k so yes another $1k a month is a decent amount. Had she held off on the house and kids she could have put much more money into the loan and gotten it paid off. Short term sacrifice to open opportunity later. As of now she can't afford to not work with that debt load so she is tied down and is essentially forced to carry disability ins and the like just to make sure they can service the student loan debt. I don't know too many people are are making better than 7% on conservative investments right now so I don't know that saving the money rather than paying down the debt is better at this point. Anyway, everyone's situation is different. For me, I am glad I will be debt free including my house by my mid 40's, I don't find seeking financial freedom as early as possible to be a short sighted endeavor, I find it to be a good way to protect me and my family's financial future as well as possible. A debt free person doesn't sweat near as much as a debt laden person when they get laid off. |

2013-09-19 11:12 AM 2013-09-19 11:12 AM in reply to: tuwood in reply to: tuwood |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOn the student loan discussion. It is almost comical to me how obvious the issue is, yet nobody can see it. What happened prior to 2008? We had everybody and their little brother giving loans to anybody who could fog a mirror. Housing prices went through the roof and everybody started defaulting on their government backed loans. It went pop. What's happening now in the university world? Unlimited access to government student loan money is driving everyone and their cat to college. Huge new industry of online universities and non traditional programs to "get your masters degree in 6 months". People flocked to these programs because the money was really easy to get. Fill out a FAFSA and here's your $50k, and here's your degree. Colleges then start raising their rates higher and higher because the demand for their services continues to shoot through the roof. There are multiple reasons for the demand spike, but the crappy economy and unemployment are also factors. Hey, if I can't work I might as well go to school for "free" on student loans. This has resulted in a mass increase in student loan debt of which 85% is backed by the government, just like the mortgage debt problem the easy access to money is leading to another economic train wreck. The mass influx of "educated" workers is also putting downward wage pressure on wages for college grads which just compounds the problem. More debt, but less income as a result. So yet again, the government is trying to "help everyone" by providing unlimited access to education money, but it's simply resulting in colleges jacking their rates for everyone and building yet another bubble that will pop. If you recall earlier this year the government had to shore things up to keep the rates low, so more people could get loans... /deja vu facepalm Take a look at these charts that show the governments increase in student debt, and the consumer default rates on that debt: |

2013-09-19 11:27 AM 2013-09-19 11:27 AM in reply to: tuwood in reply to: tuwood |

Elite  4564 4564      Boise Boise |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementTony is a pessimist like myself. You also can't forget that student loan debt is not dischargable in bankruptcy in all but 1% of cases. It will just build up interest if you can't pay it. |

2013-09-19 11:35 AM 2013-09-19 11:35 AM in reply to: Left Brain in reply to: Left Brain |

Elite  4564 4564      Boise Boise |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by Left BrainJosh....no offense, but you tend to look at the negative side of everything. I didn't move a single penny when the market crashed and everyone I knew bailed out. All it meant to me was that I was buying CHEAP by staying in. The market isn't run by guys with negative attitudes.....it's run by people who want to make money. You can't sit in your seat and make predicitons about what the Fed is doing, etc......you just don't have access to that information. What you have to do is look at long term trends. Here, without getting into exact numbers, I have an account I opened in 1986. I have put 225,000 into it...... it's worth 610,000 today. I'm happy with that return, and I'm happy I didn't try to use themoney I put into that account to pay off my house, or student loans, or any other debt.....because the debt got paid off anyway, and I have that account waiting on me that will bridge me over to my pension account. Since you like to make predicitons.....I'll make one too..... go ahead and sit on the sideline and wring your hands....you're about to miss out on one of the biggest economic recoveries in history. It's what giant economies do....they go up and down. The size of the recoveries tend to mirror the size of the downturns. There is alot to be happy about with the housing numbers, oil production, natural gas production, and general growth of the economy. You can say the Fed is propping up the markets all you want......the Fed doesn't make the markets run.....the guys making the money do. Just because I'm a numbers guy, I ran the math and according to this http://www.pine-grove.com/online-calculators/roi-calculator.htm you made 4% annually. That's before inflation is taken into account too so if you were to record your real money growth (using this calculator http://www.westegg.com/inflation/ ) it would go down substantially. Of course it's your money and if you're hapy with it then life is good |

2013-09-19 11:40 AM 2013-09-19 11:40 AM in reply to: JoshR in reply to: JoshR |

Champion  14571 14571        the alamo city, Texas the alamo city, Texas |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by JoshR Tony is a pessimist like myself. You also can't forget that student loan debt is not dischargable in bankruptcy in all but 1% of cases. It will just build up interest if you can't pay it. you really ARE a pessimist if you make financial decisions based on a potential path to bankruptcy |

|

2013-09-19 11:50 AM 2013-09-19 11:50 AM in reply to: mehaner in reply to: mehaner |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by mehaner Originally posted by JoshR Tony is a pessimist like myself. You also can't forget that student loan debt is not dischargable in bankruptcy in all but 1% of cases. It will just build up interest if you can't pay it. you really ARE a pessimist if you make financial decisions based on a potential path to bankruptcy lol, that's funny. I've contemplated on the non dischargeable nature of student loans and how it would effect things in the long run. With the mortgage crisis for example if I couldn't pay my loan I just filed bankruptcy and the bank/government ate it all. Within a few years my credit is back on the mend and I can go buy another house and car and move on with my life. However with student loans, you have the banks lending the money with 85% of it backed by the Feds. If I default on my loan by stopping the payments, I cannot discharge it in a bankruptcy so it haunts me for the rest of my life. It's a lot harder to get a credit card, buy a house, or get a car. The bank is still out the same $ and the government has to pay them (similar to the mortgage crisis) but the consumer gets dragged down a lot longer. So, overall it seems to be the same net loss for the Banks/Governmnet yet also hurts the consumer. Now granted if they get back on their feet, the bank/government could recoup some of that down the road, but it's hard to determine what those percentages are. |

2013-09-19 12:13 PM 2013-09-19 12:13 PM in reply to: tuwood in reply to: tuwood |

Elite  4564 4564      Boise Boise |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by tuwood Originally posted by mehaner Originally posted by JoshR Tony is a pessimist like myself. You also can't forget that student loan debt is not dischargable in bankruptcy in all but 1% of cases. It will just build up interest if you can't pay it. you really ARE a pessimist if you make financial decisions based on a potential path to bankruptcy lol, that's funny. I've contemplated on the non dischargeable nature of student loans and how it would effect things in the long run. With the mortgage crisis for example if I couldn't pay my loan I just filed bankruptcy and the bank/government ate it all. Within a few years my credit is back on the mend and I can go buy another house and car and move on with my life. However with student loans, you have the banks lending the money with 85% of it backed by the Feds. If I default on my loan by stopping the payments, I cannot discharge it in a bankruptcy so it haunts me for the rest of my life. It's a lot harder to get a credit card, buy a house, or get a car. The bank is still out the same $ and the government has to pay them (similar to the mortgage crisis) but the consumer gets dragged down a lot longer. So, overall it seems to be the same net loss for the Banks/Governmnet yet also hurts the consumer. Now granted if they get back on their feet, the bank/government could recoup some of that down the road, but it's hard to determine what those percentages are. The other thing is if you are in a situation where you would be trying to discharge it via bankruptcy, you will most likely be accrusing interest which is just going to make it that much more difficult for you down the road. |

2013-09-19 12:14 PM 2013-09-19 12:14 PM in reply to: mehaner in reply to: mehaner |

Elite  4564 4564      Boise Boise |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by mehaner Originally posted by JoshR Tony is a pessimist like myself. You also can't forget that student loan debt is not dischargable in bankruptcy in all but 1% of cases. It will just build up interest if you can't pay it. you really ARE a pessimist if you make financial decisions based on a potential path to bankruptcy It's something you have to consider. As I said though, I'm an optimist in my own life, I've got a good job, baby #2 is on the way, an amazing wife and I was able to buy a house at the absolute bottom of the market that has almost doubled in value in 2 years. |

2013-09-19 12:36 PM 2013-09-19 12:36 PM in reply to: JoshR in reply to: JoshR |

Champion  10020 10020   , Minnesota , Minnesota |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementI paid off my students loans with the money made on the sale of our house during the good real estate times. I still can't believe I talked my husband into that one! Anyway, the interest rates were higher than our new mortgage interest rate, so that seemed to make sense. I have no debt other than our home (not underwater, either) and I think I am actually suffering a little bit of this entitlement let-down discussed in the Huff Post article. Without any of the additional pressures that might make me unhappy, like debt or lacking health care, I am still unhappy. I feel like I am having a mid-life crisis at age 36. I sped through life by going to college in high school, graduating from college in just 3 years, and after a year break doing a master's degree in 2.5 years. From that point, for several years, it was up-up-up! I got every job I wanted, I got more responsibility, more pay, etc. Now I am in the terminal job for a Librarian (director) and I am sorely disappointed. The pay kind of stinks, relatively speaking, I am not interested in what I am doing, and it is starting to appear in job interviews that I am pigeonholed because my current title is too fancy for any recruiter to accept that I might be okay not directing/managing anyone other than myself, despite my assurances and explanations. I am now faced with either accepting my fate (hard to do when I am looking at another 30+ years of work) or reinventing myself. Right now I am working on figuring what skills I already have and how they might work in a different type of field, but if that doesn't work then what? And also, if I do leave behind librarianship, I feel like I wasted my time. I guess I wouldn't have described this as entitlement, but maybe it is a little bit in the context of this discussion. I had expectations, that's for sure. Yep, definitely an early mid-life crisis. |

2013-09-19 12:54 PM 2013-09-19 12:54 PM in reply to: JoshR in reply to: JoshR |

Expert  2180 2180      Boise, Idaho Boise, Idaho |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOK, you finance-savy folks, help me out! I've lived by a simple mantra that if my loan interest is higher than my earnings percentage-then I pay off the debt first. Is this a 'sound' idea or am i cutting my own throat down the line. Or should this be another 'Thread'? |

|

2013-09-19 1:08 PM 2013-09-19 1:08 PM in reply to: 0 in reply to: 0 |

Pro  15655 15655       |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by JoshR Originally posted by Left BrainJosh....no offense, but you tend to look at the negative side of everything. I didn't move a single penny when the market crashed and everyone I knew bailed out. All it meant to me was that I was buying CHEAP by staying in. The market isn't run by guys with negative attitudes.....it's run by people who want to make money. You can't sit in your seat and make predicitons about what the Fed is doing, etc......you just don't have access to that information. What you have to do is look at long term trends. Here, without getting into exact numbers, I have an account I opened in 1986. I have put 225,000 into it...... it's worth 610,000 today. I'm happy with that return, and I'm happy I didn't try to use themoney I put into that account to pay off my house, or student loans, or any other debt.....because the debt got paid off anyway, and I have that account waiting on me that will bridge me over to my pension account. Just because I'm a numbers guy, I ran the math and according to this http://www.pine-grove.com/online-calculators/roi-calculator.htmyou made 4% annually. That's before inflation is taken into account too so if you were to record your real money growth (using this calculator http://www.westegg.com/inflation/) it would go down substantially. Of course it's your money and if you're hapy with it then life is goodSince you like to make predicitons.....I'll make one too..... go ahead and sit on the sideline and wring your hands....you're about to miss out on one of the biggest economic recoveries in history. It's what giant economies do....they go up and down. The size of the recoveries tend to mirror the size of the downturns. There is alot to be happy about with the housing numbers, oil production, natural gas production, and general growth of the economy. You can say the Fed is propping up the markets all you want......the Fed doesn't make the markets run.....the guys making the money do. Eh....not entirely accurate. There were many years I put NOTHING into that account and other years I dumped money into them regularly. For the record, a 4-5% annual return is more than fine with me. When I run the numbers for our retirement income I use 2.5% as where I'd like to be as we draw our accounts down. You are somehow assuming I put all 225,000 into that account at one time. I have made quite a bit more than 4% on the money I've put in. In the beginning I could barely afford to put much in.

Edited by Left Brain 2013-09-19 1:20 PM |

2013-09-19 1:33 PM 2013-09-19 1:33 PM in reply to: jeffnboise in reply to: jeffnboise |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by jeffnboise OK, you finance-savy folks, help me out! I've lived by a simple mantra that if my loan interest is higher than my earnings percentage-then I pay off the debt first. Is this a 'sound' idea or am i cutting my own throat down the line. Or should this be another 'Thread'? I don't know if I'm savvy or not, but there are two ways to look at it. There is the opportunity cost method which is to say what is this money worth elsewhere if I don't pay down this debt. So, if you've got a 2% student loan interest rate and you can make 6% consistently via some other method then you're better off leaving the student debt and investing the money elsewhere. This is what you're describing. This was a popular mantra back in the pre 2008 days with mortgages. I can refinance my house at 120% LTF at 6% interest and the stock market is consistently making 10% annual returns and/or I have a credit card with 20% interest so I'm better off investing the money or paying off my card. From a math standpoint these are all sound things to do and if all things stay the same, it will work. However, from a reality standpoint, things don't always stay the same and unforseen events such as the market crashing, losing your job, and your home losing half it's value can happen. So now your sound investment strategy winds you up with a house financed at 240% LTV. I have a friend of mine here in Omaha that was very conservative in his savings and investing and always paid extra money down on their house to maximize their equity. He was so paranoid about losing his house and prioritize it above all other investments and savings. He had an old house that sold with $100k of equity in it and he sent all $100k to his house and put none of it in savings. So, with hindsite on his situation he would have been much better off taking that $100k and investing it somewhere conservative as an emergency fund. My philosophy is generally in line with what you're saying to pay things down if the rate is higher than the alternative. However, I won't pay anything down unless I have at least 6 months of liquid savings (emergency fund) no matter what the interest rate. Once I go over that 6 month rate, then I invoke the whatever gets me more money approach. |

2013-09-19 2:01 PM 2013-09-19 2:01 PM in reply to: Left Brain in reply to: Left Brain |

Elite  4564 4564      Boise Boise |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by Left Brain Originally posted by JoshR Originally posted by Left BrainJosh....no offense, but you tend to look at the negative side of everything. I didn't move a single penny when the market crashed and everyone I knew bailed out. All it meant to me was that I was buying CHEAP by staying in. The market isn't run by guys with negative attitudes.....it's run by people who want to make money. You can't sit in your seat and make predicitons about what the Fed is doing, etc......you just don't have access to that information. What you have to do is look at long term trends. Here, without getting into exact numbers, I have an account I opened in 1986. I have put 225,000 into it...... it's worth 610,000 today. I'm happy with that return, and I'm happy I didn't try to use themoney I put into that account to pay off my house, or student loans, or any other debt.....because the debt got paid off anyway, and I have that account waiting on me that will bridge me over to my pension account. Just because I'm a numbers guy, I ran the math and according to this http://www.pine-grove.com/online-calculators/roi-calculator.htmyou made 4% annually. That's before inflation is taken into account too so if you were to record your real money growth (using this calculator http://www.westegg.com/inflation/) it would go down substantially. Of course it's your money and if you're hapy with it then life is goodSince you like to make predicitons.....I'll make one too..... go ahead and sit on the sideline and wring your hands....you're about to miss out on one of the biggest economic recoveries in history. It's what giant economies do....they go up and down. The size of the recoveries tend to mirror the size of the downturns. There is alot to be happy about with the housing numbers, oil production, natural gas production, and general growth of the economy. You can say the Fed is propping up the markets all you want......the Fed doesn't make the markets run.....the guys making the money do. Eh....not entirely accurate. There were many years I put NOTHING into that account and other years I dumped money into them regularly. For the record, a 4-5% annual return is more than fine with me. When I run the numbers for our retirement income I use 2.5% as where I'd like to be as we draw our accounts down. You are somehow assuming I put all 225,000 into that account at one time. I have made quite a bit more than 4% on the money I've put in. In the beginning I could barely afford to put much in.

Durrr. I just read it as a math problem. Invest 225k for 26 years end up with 610k and what's the ROI? |

2013-09-19 2:05 PM 2013-09-19 2:05 PM in reply to: JoshR in reply to: JoshR |

Pro  15655 15655       |  Subject: RE: Gen Y Entitlement Subject: RE: Gen Y EntitlementOriginally posted by JoshR Originally posted by Left Brain Durrr. I just read it as a math problem. Invest 225k for 26 years end up with 610k and what's the ROI? Originally posted by JoshR Originally posted by Left BrainJosh....no offense, but you tend to look at the negative side of everything. I didn't move a single penny when the market crashed and everyone I knew bailed out. All it meant to me was that I was buying CHEAP by staying in. The market isn't run by guys with negative attitudes.....it's run by people who want to make money. You can't sit in your seat and make predicitons about what the Fed is doing, etc......you just don't have access to that information. What you have to do is look at long term trends. Here, without getting into exact numbers, I have an account I opened in 1986. I have put 225,000 into it...... it's worth 610,000 today. I'm happy with that return, and I'm happy I didn't try to use themoney I put into that account to pay off my house, or student loans, or any other debt.....because the debt got paid off anyway, and I have that account waiting on me that will bridge me over to my pension account. Just because I'm a numbers guy, I ran the math and according to this http://www.pine-grove.com/online-calculators/roi-calculator.htmyou made 4% annually. That's before inflation is taken into account too so if you were to record your real money growth (using this calculator http://www.westegg.com/inflation/) it would go down substantially. Of course it's your money and if you're hapy with it then life is goodSince you like to make predicitons.....I'll make one too..... go ahead and sit on the sideline and wring your hands....you're about to miss out on one of the biggest economic recoveries in history. It's what giant economies do....they go up and down. The size of the recoveries tend to mirror the size of the downturns. There is alot to be happy about with the housing numbers, oil production, natural gas production, and general growth of the economy. You can say the Fed is propping up the markets all you want......the Fed doesn't make the markets run.....the guys making the money do. Eh....not entirely accurate. There were many years I put NOTHING into that account and other years I dumped money into them regularly. For the record, a 4-5% annual return is more than fine with me. When I run the numbers for our retirement income I use 2.5% as where I'd like to be as we draw our accounts down. You are somehow assuming I put all 225,000 into that account at one time. I have made quite a bit more than 4% on the money I've put in. In the beginning I could barely afford to put much in.

I know you did.....I can do the math as well. |

|

login

login

View profile

View profile Add to friends

Add to friends Go to training log

Go to training log Go to race log

Go to race log Send a message

Send a message View album

View album

CONNECT WITH FACEBOOK

CONNECT WITH FACEBOOK