Obama's wants to cap tax credits on IRAs (Page 4)

-

No new posts

No new posts

| Moderators: k9car363, the bear, DerekL, alicefoeller | Reply |

|

2013-04-13 4:19 PM 2013-04-13 4:19 PM in reply to: #4698856 in reply to: #4698856 |

Pro  6838 6838        Tejas Tejas |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAstrinnas - 2013-04-13 10:46 AM running2far - 2013-04-13 11:19 AM tuwood - 2013-04-12 4:18 PM I can guarantee they will continue to invest, moving with their target. All investment would be taxed, so they just don't invest? The only thing left, being a tax evader or just spend everything and do not invest. chirunner134 - 2013-04-12 3:23 PM Birkierunner - 2013-04-12 2:09 PM . I'm referring more to the comments made by some that "no one needs more than 3 million to retire". I'm the one who decides that....and I won't be anywhere close. Where did I say anything about what I do/invest within my retirement plan ? Who said anything about the gov't funding my retirement? I do not think anyone saying you can't save more than that. If you can great way to go. My point if if you have 3 mil chances are you will not starve or even have any worries financial worries. If you retire right now with 3 mil in the bank you can live better than most people in America. The true irony of all this is it will probably result in a negative tax gain and likely give the government less revenue. I can pretty much guarantee you that anyone who does have a 401k that goes north of $3M will never put another dime into it. They may get a quick one time hit, but that's it and then they'll completely remove the incentive for said individual to invest in their 401k and she'll take the money elsewhere to avoid it being taxed. Ask California how all their tax increases are working out in the revenue dept. If I came to your house and took all the money you left on your coffee table you'd most certainly not put any money on the coffee table the next time I come over. Not necessarily. They could invest in lower yield but still tax free instruments such as muni bonds outside their 401ks. It would depend on the after tax yield vs risk aspect of other possible investments. The Fed has destroyed the Muni market |

|

2013-04-15 7:32 AM 2013-04-15 7:32 AM in reply to: #4699025 in reply to: #4699025 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsthe bear - 2013-04-13 2:32 PM tuwood - 2013-04-13 11:06 AM running2far - 2013-04-13 10:19 AM tuwood - 2013-04-12 4:18 PM I can guarantee they will continue to invest, moving with their target. All investment would be taxed, so they just don't invest? The only thing left, being a tax evader or just spend everything and do not invest. chirunner134 - 2013-04-12 3:23 PM Birkierunner - 2013-04-12 2:09 PM . I'm referring more to the comments made by some that "no one needs more than 3 million to retire". I'm the one who decides that....and I won't be anywhere close. Where did I say anything about what I do/invest within my retirement plan ? Who said anything about the gov't funding my retirement? I do not think anyone saying you can't save more than that. If you can great way to go. My point if if you have 3 mil chances are you will not starve or even have any worries financial worries. If you retire right now with 3 mil in the bank you can live better than most people in America. The true irony of all this is it will probably result in a negative tax gain and likely give the government less revenue. I can pretty much guarantee you that anyone who does have a 401k that goes north of $3M will never put another dime into it. They may get a quick one time hit, but that's it and then they'll completely remove the incentive for said individual to invest in their 401k and she'll take the money elsewhere to avoid it being taxed. Ask California how all their tax increases are working out in the revenue dept. If I came to your house and took all the money you left on your coffee table you'd most certainly not put any money on the coffee table the next time I come over. Obviously they're going to continue to invest, just not in 401k's anymore which was my point. Um, isn't the purpose of the proposal to not allow contributions to (401k and other) accounts over $3MM? And the resulting tax deferment that comes from the contribution? How is that going to result in a negative tax gain, when the government limits the deferment? Folks are still going to earn the money, aren't they, just won't be able to defer the taxes. No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. I use the analogy of California where they raised taxes on the rich to increase revenue, but the end result was an overall reduction in revenue. Laffer curve in action. |

2013-04-15 9:36 AM 2013-04-15 9:36 AM in reply to: #4700275 in reply to: #4700275 |

Champion  6999 6999           Chicago, Illinois Chicago, Illinois |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAstuwood - 2013-04-15 7:32 AM No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. Well government does not get anything now so even if your right nothing changed for them really. You would say that money would not get taxed either way. I am confused where does the money go? If I would have put in 5 mil into my ira but now I put in 3. Where does the other 2 mil go and why would it not be taxed? If I earned it in wages I would pay income tax on it and if I put it into some money market or something I would pay taxes on capital gains right? Edited by chirunner134 2013-04-15 9:43 AM |

2013-04-15 9:48 AM 2013-04-15 9:48 AM in reply to: #4700275 in reply to: #4700275 |

Resident Curmudgeon  25290 25290           The Road Back The Road Back |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAstuwood - 2013-04-15 7:32 AM read the article again. There is no revenue-raising penalty proposed, only the removal of benefits (tax deferment) for contributions to accounts over the threshold .the bear - 2013-04-13 2:32 PM tuwood - 2013-04-13 11:06 AM running2far - 2013-04-13 10:19 AM tuwood - 2013-04-12 4:18 PM I can guarantee they will continue to invest, moving with their target. All investment would be taxed, so they just don't invest? The only thing left, being a tax evader or just spend everything and do not invest. chirunner134 - 2013-04-12 3:23 PM Birkierunner - 2013-04-12 2:09 PM . I'm referring more to the comments made by some that "no one needs more than 3 million to retire". I'm the one who decides that....and I won't be anywhere close. Where did I say anything about what I do/invest within my retirement plan ? Who said anything about the gov't funding my retirement? I do not think anyone saying you can't save more than that. If you can great way to go. My point if if you have 3 mil chances are you will not starve or even have any worries financial worries. If you retire right now with 3 mil in the bank you can live better than most people in America. The true irony of all this is it will probably result in a negative tax gain and likely give the government less revenue. I can pretty much guarantee you that anyone who does have a 401k that goes north of $3M will never put another dime into it. They may get a quick one time hit, but that's it and then they'll completely remove the incentive for said individual to invest in their 401k and she'll take the money elsewhere to avoid it being taxed. Ask California how all their tax increases are working out in the revenue dept. If I came to your house and took all the money you left on your coffee table you'd most certainly not put any money on the coffee table the next time I come over. Obviously they're going to continue to invest, just not in 401k's anymore which was my point. Um, isn't the purpose of the proposal to not allow contributions to (401k and other) accounts over $3MM? And the resulting tax deferment that comes from the contribution? How is that going to result in a negative tax gain, when the government limits the deferment? Folks are still going to earn the money, aren't they, just won't be able to defer the taxes. No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. I use the analogy of California where they raised taxes on the rich to increase revenue, but the end result was an overall reduction in revenue. Laffer curve in action. |

2013-04-15 10:39 AM 2013-04-15 10:39 AM in reply to: #4700488 in reply to: #4700488 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAschirunner134 - 2013-04-15 9:36 AM tuwood - 2013-04-15 7:32 AM No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. Well government does not get anything now so even if your right nothing changed for them really. You would say that money would not get taxed either way. I am confused where does the money go? If I would have put in 5 mil into my ira but now I put in 3. Where does the other 2 mil go and why would it not be taxed? If I earned it in wages I would pay income tax on it and if I put it into some money market or something I would pay taxes on capital gains right? A wealthy individual who would normally put the extra $2M in their IRA for tax free gains would now put it elsewhere. Could he put it in an investment that incurs tax penalties, absolutely. I would venture that he will seek out other tax deferred investments to put the money. If there are none, she may choose to leave it in cash and not invest it at all, due to horrible market returns which hurts the economy even more. |

2013-04-15 10:39 AM 2013-04-15 10:39 AM in reply to: #4695345 in reply to: #4695345 |

Champion  34263 34263             Chicago Chicago |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsYou could always buy gold and make mon -- oops, nevermind. |

|

2013-04-15 10:41 AM 2013-04-15 10:41 AM in reply to: #4700516 in reply to: #4700516 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsthe bear - 2013-04-15 9:48 AM tuwood - 2013-04-15 7:32 AM read the article again. There is no revenue-raising penalty proposed, only the removal of benefits (tax deferment) for contributions to accounts over the threshold .the bear - 2013-04-13 2:32 PM tuwood - 2013-04-13 11:06 AM running2far - 2013-04-13 10:19 AM tuwood - 2013-04-12 4:18 PM I can guarantee they will continue to invest, moving with their target. All investment would be taxed, so they just don't invest? The only thing left, being a tax evader or just spend everything and do not invest. chirunner134 - 2013-04-12 3:23 PM Birkierunner - 2013-04-12 2:09 PM . I'm referring more to the comments made by some that "no one needs more than 3 million to retire". I'm the one who decides that....and I won't be anywhere close. Where did I say anything about what I do/invest within my retirement plan ? Who said anything about the gov't funding my retirement? I do not think anyone saying you can't save more than that. If you can great way to go. My point if if you have 3 mil chances are you will not starve or even have any worries financial worries. If you retire right now with 3 mil in the bank you can live better than most people in America. The true irony of all this is it will probably result in a negative tax gain and likely give the government less revenue. I can pretty much guarantee you that anyone who does have a 401k that goes north of $3M will never put another dime into it. They may get a quick one time hit, but that's it and then they'll completely remove the incentive for said individual to invest in their 401k and she'll take the money elsewhere to avoid it being taxed. Ask California how all their tax increases are working out in the revenue dept. If I came to your house and took all the money you left on your coffee table you'd most certainly not put any money on the coffee table the next time I come over. Obviously they're going to continue to invest, just not in 401k's anymore which was my point. Um, isn't the purpose of the proposal to not allow contributions to (401k and other) accounts over $3MM? And the resulting tax deferment that comes from the contribution? How is that going to result in a negative tax gain, when the government limits the deferment? Folks are still going to earn the money, aren't they, just won't be able to defer the taxes. No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. I use the analogy of California where they raised taxes on the rich to increase revenue, but the end result was an overall reduction in revenue. Laffer curve in action. You say tomato, i say tomahto. lol. So if the net result of them making this change increases the $ an individual has to send to the government, then what exactly is the difference? |

2013-04-15 10:42 AM 2013-04-15 10:42 AM in reply to: #4695345 in reply to: #4695345 |

Regular  1023 1023  Madrid Madrid |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsThat said, it is a lot cheaper today... |

2013-04-15 10:43 AM 2013-04-15 10:43 AM in reply to: #4700627 in reply to: #4700627 |

Champion  34263 34263             Chicago Chicago |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsgr33n - 2013-04-15 10:42 AM That said, it is a lot cheaper today... Value buying later this week? |

2013-04-15 10:44 AM 2013-04-15 10:44 AM in reply to: #4700616 in reply to: #4700616 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsmr2tony - 2013-04-15 10:39 AM You could always buy gold and make mon -- oops, nevermind. lol, my business partner is a big "physical gold" guy. I've been telling him for quite some time it's nothing more than a hype bubble that's going to pop. We shall see... |

2013-04-15 10:45 AM 2013-04-15 10:45 AM in reply to: #4700613 in reply to: #4700613 |

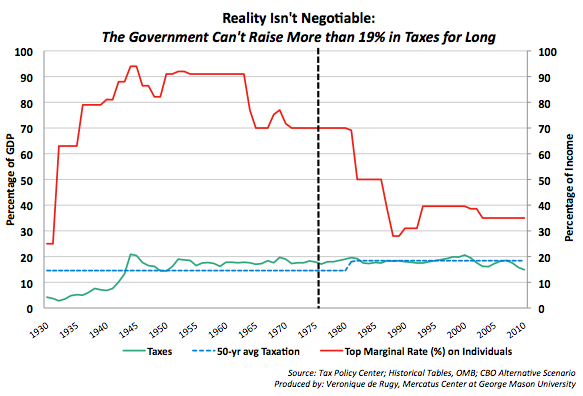

Champion  7347 7347       SRQ, FL SRQ, FL |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAstuwood - 2013-04-15 11:39 AM My overall point was simply that due to the basic economic Laffer Curve theory, increasing taxes causes individuals to shift their money around to more advantageous places. It's never as simple as raise taxes and get X amount of new money. Yep. It's about 19% of GDP. No matter the top tax bracket the effective tax rate remains about 19%.

|

|

2013-04-15 10:48 AM 2013-04-15 10:48 AM in reply to: #4700613 in reply to: #4700613 |

Sneaky Slow  8694 8694         Herndon, VA, Herndon, VA, |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAstuwood - 2013-04-15 11:39 AM Speaking of not as simple, that is not what the Laffer Curve implies. It implies that only after the tax rate has reached a certain point, which is debated to be anywhere from 35% to 70%. Whatever the "true" number is, the Laffer Curve is not a good example for this particular scenario, since the gains in IRAs are subject to capital gains, which is well under that peak on the Laffer Curve by any reasonable estimation.chirunner134 - 2013-04-15 9:36 AM tuwood - 2013-04-15 7:32 AM No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. Well government does not get anything now so even if your right nothing changed for them really. You would say that money would not get taxed either way. I am confused where does the money go? If I would have put in 5 mil into my ira but now I put in 3. Where does the other 2 mil go and why would it not be taxed? If I earned it in wages I would pay income tax on it and if I put it into some money market or something I would pay taxes on capital gains right? A wealthy individual who would normally put the extra $2M in their IRA for tax free gains would now put it elsewhere. Could he put it in an investment that incurs tax penalties, absolutely. I would venture that he will seek out other tax deferred investments to put the money. If there are none, she may choose to leave it in cash and not invest it at all, due to horrible market returns which hurts the economy even more. http://voices.washingtonpost.com/ezra-klein/2010/08/where_does_the_laffer_curve_be.html Edited by tealeaf 2013-04-15 10:51 AM |

2013-04-15 11:04 AM 2013-04-15 11:04 AM in reply to: #4695345 in reply to: #4695345 |

over a barrier over a barrier |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsBitcoins is a stable investment, aw never mind. |

2013-04-15 11:47 AM 2013-04-15 11:47 AM in reply to: #4700623 in reply to: #4700623 |

Resident Curmudgeon  25290 25290           The Road Back The Road Back |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAstuwood - 2013-04-15 10:41 AM So explain again your assertion that this proposal will cost the government tax revenues.the bear - 2013-04-15 9:48 AM tuwood - 2013-04-15 7:32 AM read the article again. There is no revenue-raising penalty proposed, only the removal of benefits (tax deferment) for contributions to accounts over the threshold .the bear - 2013-04-13 2:32 PM tuwood - 2013-04-13 11:06 AM running2far - 2013-04-13 10:19 AM tuwood - 2013-04-12 4:18 PM I can guarantee they will continue to invest, moving with their target. All investment would be taxed, so they just don't invest? The only thing left, being a tax evader or just spend everything and do not invest. chirunner134 - 2013-04-12 3:23 PM Birkierunner - 2013-04-12 2:09 PM . I'm referring more to the comments made by some that "no one needs more than 3 million to retire". I'm the one who decides that....and I won't be anywhere close. Where did I say anything about what I do/invest within my retirement plan ? Who said anything about the gov't funding my retirement? I do not think anyone saying you can't save more than that. If you can great way to go. My point if if you have 3 mil chances are you will not starve or even have any worries financial worries. If you retire right now with 3 mil in the bank you can live better than most people in America. The true irony of all this is it will probably result in a negative tax gain and likely give the government less revenue. I can pretty much guarantee you that anyone who does have a 401k that goes north of $3M will never put another dime into it. They may get a quick one time hit, but that's it and then they'll completely remove the incentive for said individual to invest in their 401k and she'll take the money elsewhere to avoid it being taxed. Ask California how all their tax increases are working out in the revenue dept. If I came to your house and took all the money you left on your coffee table you'd most certainly not put any money on the coffee table the next time I come over. Obviously they're going to continue to invest, just not in 401k's anymore which was my point. Um, isn't the purpose of the proposal to not allow contributions to (401k and other) accounts over $3MM? And the resulting tax deferment that comes from the contribution? How is that going to result in a negative tax gain, when the government limits the deferment? Folks are still going to earn the money, aren't they, just won't be able to defer the taxes. No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. I use the analogy of California where they raised taxes on the rich to increase revenue, but the end result was an overall reduction in revenue. Laffer curve in action. You say tomato, i say tomahto. lol. So if the net result of them making this change increases the $ an individual has to send to the government, then what exactly is the difference? |

2013-04-15 12:07 PM 2013-04-15 12:07 PM in reply to: #4700813 in reply to: #4700813 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsthe bear - 2013-04-15 11:47 AM tuwood - 2013-04-15 10:41 AM So explain again your assertion that this proposal will cost the government tax revenues.the bear - 2013-04-15 9:48 AM tuwood - 2013-04-15 7:32 AM read the article again. There is no revenue-raising penalty proposed, only the removal of benefits (tax deferment) for contributions to accounts over the threshold .the bear - 2013-04-13 2:32 PM tuwood - 2013-04-13 11:06 AM running2far - 2013-04-13 10:19 AM tuwood - 2013-04-12 4:18 PM I can guarantee they will continue to invest, moving with their target. All investment would be taxed, so they just don't invest? The only thing left, being a tax evader or just spend everything and do not invest. chirunner134 - 2013-04-12 3:23 PM Birkierunner - 2013-04-12 2:09 PM . I'm referring more to the comments made by some that "no one needs more than 3 million to retire". I'm the one who decides that....and I won't be anywhere close. Where did I say anything about what I do/invest within my retirement plan ? Who said anything about the gov't funding my retirement? I do not think anyone saying you can't save more than that. If you can great way to go. My point if if you have 3 mil chances are you will not starve or even have any worries financial worries. If you retire right now with 3 mil in the bank you can live better than most people in America. The true irony of all this is it will probably result in a negative tax gain and likely give the government less revenue. I can pretty much guarantee you that anyone who does have a 401k that goes north of $3M will never put another dime into it. They may get a quick one time hit, but that's it and then they'll completely remove the incentive for said individual to invest in their 401k and she'll take the money elsewhere to avoid it being taxed. Ask California how all their tax increases are working out in the revenue dept. If I came to your house and took all the money you left on your coffee table you'd most certainly not put any money on the coffee table the next time I come over. Obviously they're going to continue to invest, just not in 401k's anymore which was my point. Um, isn't the purpose of the proposal to not allow contributions to (401k and other) accounts over $3MM? And the resulting tax deferment that comes from the contribution? How is that going to result in a negative tax gain, when the government limits the deferment? Folks are still going to earn the money, aren't they, just won't be able to defer the taxes. No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. I use the analogy of California where they raised taxes on the rich to increase revenue, but the end result was an overall reduction in revenue. Laffer curve in action. You say tomato, i say tomahto. lol. So if the net result of them making this change increases the $ an individual has to send to the government, then what exactly is the difference? My assertion is that it will result in little if any new tax revenue for the government because the people it applies to will shift their money around. They may get a quick hit for the people that are in this situation that can't easily move their money out of their IRA, but very little new investment over $3M will occur going forward, thereby resulting in little, if any long term revenue for the government. If you're referring to the negative rate of return comment I made, I was referring to long term tax revenues. If I put $10M in my IRA over my lifetime then I will pay taxes on it when I withdraw it which is where the government gets their tax (traditional IRA). If I am capped tax free at $3M for contributions then I'll shift the additional $7M to different (potentially more tax advantageous) investments which would reduce the amount of $ the government gets long term. |

2013-04-15 12:19 PM 2013-04-15 12:19 PM in reply to: #4695345 in reply to: #4695345 |

Resident Curmudgeon  25290 25290           The Road Back The Road Back |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsBut the tax is on income. The proposal removes the deferment of taxs on that income. It doesn't matter where the investor shifts the investment of that income. It will now be in after-tax income. |

|

2013-04-15 12:21 PM 2013-04-15 12:21 PM in reply to: #4700652 in reply to: #4700652 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAstealeaf - 2013-04-15 10:48 AM tuwood - 2013-04-15 11:39 AM chirunner134 - 2013-04-15 9:36 AM tuwood - 2013-04-15 7:32 AM No, the purpose is to raise additional revenue by penalizing people who contribute more than $3M in their 401k's. When people don't put more money into their 401k's to exceed the $3M due to the new changes then the government doesn't receive additional revenue which was their goal. Well government does not get anything now so even if your right nothing changed for them really. You would say that money would not get taxed either way. I am confused where does the money go? If I would have put in 5 mil into my ira but now I put in 3. Where does the other 2 mil go and why would it not be taxed? If I earned it in wages I would pay income tax on it and if I put it into some money market or something I would pay taxes on capital gains right? A wealthy individual who would normally put the extra $2M in their IRA for tax free gains would now put it elsewhere. Could he put it in an investment that incurs tax penalties, absolutely. I would venture that he will seek out other tax deferred investments to put the money. If there are none, she may choose to leave it in cash and not invest it at all, due to horrible market returns which hurts the economy even more. Speaking of not as simple, that is not what the Laffer Curve implies. It implies that only after the tax rate has reached a certain point, which is debated to be anywhere from 35% to 70%. Whatever the "true" number is, the Laffer Curve is not a good example for this particular scenario, since the gains in IRAs are subject to capital gains, which is well under that peak on the Laffer Curve by any reasonable estimation. That's not entirely true. When you put money into a traditional IRA it goes in tax differed. It then gains money over your lifetime and when you pass the age of retirement you can make withdrawals. Those withdrawals are taxed at your regular income rate, so if you have $10M in your retirement account odds are that you'll be in the highest tax rate for most of the money you take out. Now with a Roth IRA, you put in post tax dollars and they are not taxed at retirement when you withdraw the funds. So, in a bubble the Roth IRA would fit your assertion a little better, but I think the annual Roth contribution limit is something like $5k so it would be really hard to get it up over $3M. With a traditional IRA there are a lot of other mechanisms to get larger dollar values into it such as 401k rollovers from a company etc... |

2013-04-15 12:29 PM 2013-04-15 12:29 PM in reply to: #4700884 in reply to: #4700884 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsthe bear - 2013-04-15 12:19 PM But the tax is on income. The proposal removes the deferment of taxs on that income. It doesn't matter where the investor shifts the investment of that income. It will now be in after-tax income. Ah, my apologies. I read two or three articles on this subject in the last few days and one of them was talking about taxing what's in an existing IRA as well as the contributions. I'll still say that people with that kind of dough are likely business owners and will still shift things around, even on the front end. For example, I own a business and I pay myself a salary and max out my IRA contributions. I'm nowhere near any maxes, but if I were, I would shift things around as to how I get paid in whatever way was most advantageous from a tax standpoint. Even if I did just pay regular taxes on it today there's a chance that the government would get less revenue today than they would when I pull it out in retirement, but that's just a guess on my part. |

2013-04-15 2:48 PM 2013-04-15 2:48 PM in reply to: #4695345 in reply to: #4695345 |

Extreme Veteran  1648 1648    |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsI wonder if it is $3m per person, or per household. I'm guessing it's another marriage tax for successful couples. |

2013-04-15 5:05 PM 2013-04-15 5:05 PM in reply to: #4695345 in reply to: #4695345 |

Master  1795 1795        Boynton Beach, FL Boynton Beach, FL |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsThis point has been made in earlier posts but worth mentioning again... Obama stated that $3mm is enough for anyone to retire. This is the President of the US stating that there is a limit to one's success/wealth. I am not one to be flirting with the problem of having too much in my IRA, but I am irate just the same. Nobody and I mean nobody has the right to tell anyone they have made enough let alone pick an arbitrary # as to what that might be. There is such an evil divide in this Country on socialistic views like this and I will likely die before/if that trends turns around. I never thought that we would have a leader who so deeply divided a Country. I need a thicker mattress.... |

2013-04-15 5:09 PM 2013-04-15 5:09 PM in reply to: #4701545 in reply to: #4701545 |

Expert  960 960        Highlands Ranch, CO Highlands Ranch, CO |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAscardenas1 - 2013-04-15 4:05 PM This point has been made in earlier posts but worth mentioning again... Obama stated that $3mm is enough for anyone to retire. This is the President of the US stating that there is a limit to one's success/wealth. I am not one to be flirting with the problem of having too much in my IRA, but I am irate just the same. Nobody and I mean nobody has the right to tell anyone they have made enough let alone pick an arbitrary # as to what that might be. There is such an evil divide in this Country on socialistic views like this and I will likely die before/if that trends turns around. I never thought that we would have a leader who so deeply divided a Country. I need a thicker mattress.... Could you please point to the article where the President is quoted saying that statement? |

|

2013-04-15 5:33 PM 2013-04-15 5:33 PM in reply to: #4701547 in reply to: #4701547 |

Pro  9391 9391          Omaha, NE Omaha, NE |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAssbreaux - 2013-04-15 5:09 PM cardenas1 - 2013-04-15 4:05 PM This point has been made in earlier posts but worth mentioning again... Obama stated that $3mm is enough for anyone to retire. This is the President of the US stating that there is a limit to one's success/wealth. I am not one to be flirting with the problem of having too much in my IRA, but I am irate just the same. Nobody and I mean nobody has the right to tell anyone they have made enough let alone pick an arbitrary # as to what that might be. There is such an evil divide in this Country on socialistic views like this and I will likely die before/if that trends turns around. I never thought that we would have a leader who so deeply divided a Country. I need a thicker mattress.... Could you please point to the article where the President is quoted saying that statement? “Prohibit Individuals from Accumulating over $3 Million in Tax-Preferred Retirement Accounts. Individual Retirement Accounts and other tax-preferred savings vehicles are intended to help middle class families save for retirement. But under current rules, some wealthy individuals are able to accumulate many millions of dollars in these accounts, substantially more than is needed to fund reasonable levels of retirement saving. The Budget would limit an individual’s total balance across tax-preferred accounts to an amount sufficient to finance an annuity of not more than $205,000 per year in retirement, or about $3 million for someone retiring in 2013. This proposal would raise $9 billion over 10 years.” http://www.whitehouse.gov/sites/default/files/omb/budget/fy2014/assets/budget.pdf |

2013-04-15 6:20 PM 2013-04-15 6:20 PM in reply to: #4695345 in reply to: #4695345 |

Master  1795 1795        Boynton Beach, FL Boynton Beach, FL |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAsThank you.... Saved me a bit of cut and paste time. Listen, I wish it wasn't true. I wish that it was a misquote etc. But he is on the record more than once stating these beliefs. Sadly, which was my point, a rising population in this Country KNOW what he is saying and agree 100%. Just read over the weekend (will search for link dont worry) that 42% of Amercians beleive socialism is better than capitalism. Scary how we learn nothing from history or rather soon forget it. |

2013-04-15 7:14 PM 2013-04-15 7:14 PM in reply to: #4701545 in reply to: #4701545 |

Elite  4547 4547    |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAscardenas1 - 2013-04-15 6:05 PM This point has been made in earlier posts but worth mentioning again... Obama stated that $3mm is enough for anyone to retire. This is the President of the US stating that there is a limit to one's success/wealth. I am not one to be flirting with the problem of having too much in my IRA, but I am irate just the same. Nobody and I mean nobody has the right to tell anyone they have made enough let alone pick an arbitrary # as to what that might be. There is such an evil divide in this Country on socialistic views like this and I will likely die before/if that trends turns around. I never thought that we would have a leader who so deeply divided a Country. I need a thicker mattress.... I bolded that one line above. If only we could return to the golden era of '01 to '09 when there was no division and everyone got along so well. |

2013-04-15 7:29 PM 2013-04-15 7:29 PM in reply to: #4701631 in reply to: #4701631 |

Elite  4547 4547    |  Subject: RE: Obama's wants to cap tax credits on IRAs Subject: RE: Obama's wants to cap tax credits on IRAscardenas1 - 2013-04-15 7:20 PM Thank you.... Saved me a bit of cut and paste time. Listen, I wish it wasn't true. I wish that it was a misquote etc. But he is on the record more than once stating these beliefs. Sadly, which was my point, a rising population in this Country KNOW what he is saying and agree 100%. Just read over the weekend (will search for link dont worry) that 42% of Amercians beleive socialism is better than capitalism. Scary how we learn nothing from history or rather soon forget it. Please, this sounds like manufactured outrage to me. Perhaps you could re-state what the administration said with a bigger emphasis on the word "tax-preferred?" There would be a limit on tax-preferred accounts. Nobody is taking your money. They are basically saying if you've got $3 million in tax-preferred accounts, that's enough. You can have the rest in accounts that aren't getting such a nice deal from the government. I think we can agree to disagree on this issue. btw, I do not believe 42% of Americans prefer socialism to capitalism. I will say a majority of Americans believe in capitalism with common-sense limits. Ya know, those pesky limits that help prevent us: from having too much wealth accrete to the top, from having the middle class deteriorate, and from decreasing the odds of upward mobility for the poor.

|

|

login

login

View profile

View profile Add to friends

Add to friends Go to training log

Go to training log Go to race log

Go to race log Send a message

Send a message View album

View album

CONNECT WITH FACEBOOK

CONNECT WITH FACEBOOK